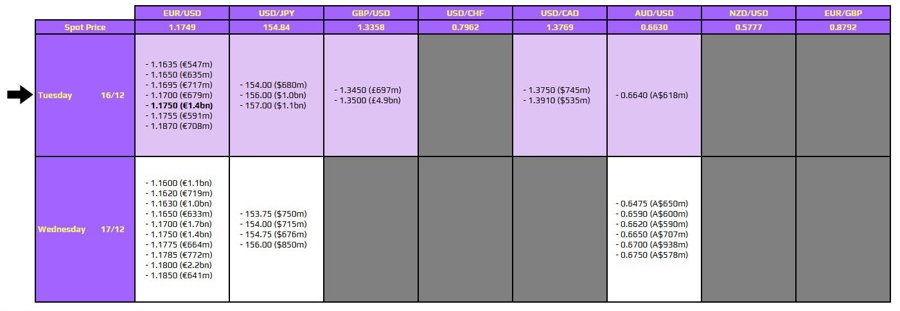

The foreign exchange market is set to experience notable movements on December 16, 2023, particularly concerning the EUR/USD pair. A significant option expiry at the 1.1750 level is anticipated, which could influence trading dynamics as traders prepare for key economic data releases later in the day.

Market Impact of EUR/USD Option Expiry

The expiry of the EUR/USD options does not align with any technical indicators; however, it could serve as a price action magnet. This situation is particularly relevant as market participants await critical economic data from the United States. The EUR/USD could exhibit heightened activity leading up to the announcements, especially with the release of the US jobs report and retail sales figures scheduled for the same day.

In the lead-up to the US data, the Euro area will also provide PMI data, which can add to the volatility in European trading hours. While the PMI data is expected to contribute to market movements, analysts suggest that any significant shifts in the EUR/USD may be limited until after the US releases.

What Traders Should Watch For

Traders are advised to monitor the EUR/USD closely around the 10:00 AM EST expiry time in New York. The potential for price fluctuations exists, yet caution is warranted as many market participants may hold off on making large decisions until the US economic indicators are revealed.

Investors seeking more insights into how to navigate these expiries and upcoming data can refer to platforms like investingLive for detailed analysis and updates. As market conditions evolve, traders will need to remain vigilant to capitalize on any opportunities that arise from the convergence of option expiries and economic data releases.