UPDATE: A groundbreaking report from Virginia-based research institute AidData reveals that China’s global lending portfolio has surged to an astonishing $2.1 trillion. This urgent update is reshaping the understanding of China’s role as the world’s largest creditor, providing critical insights into the nation’s strategic influence worldwide.

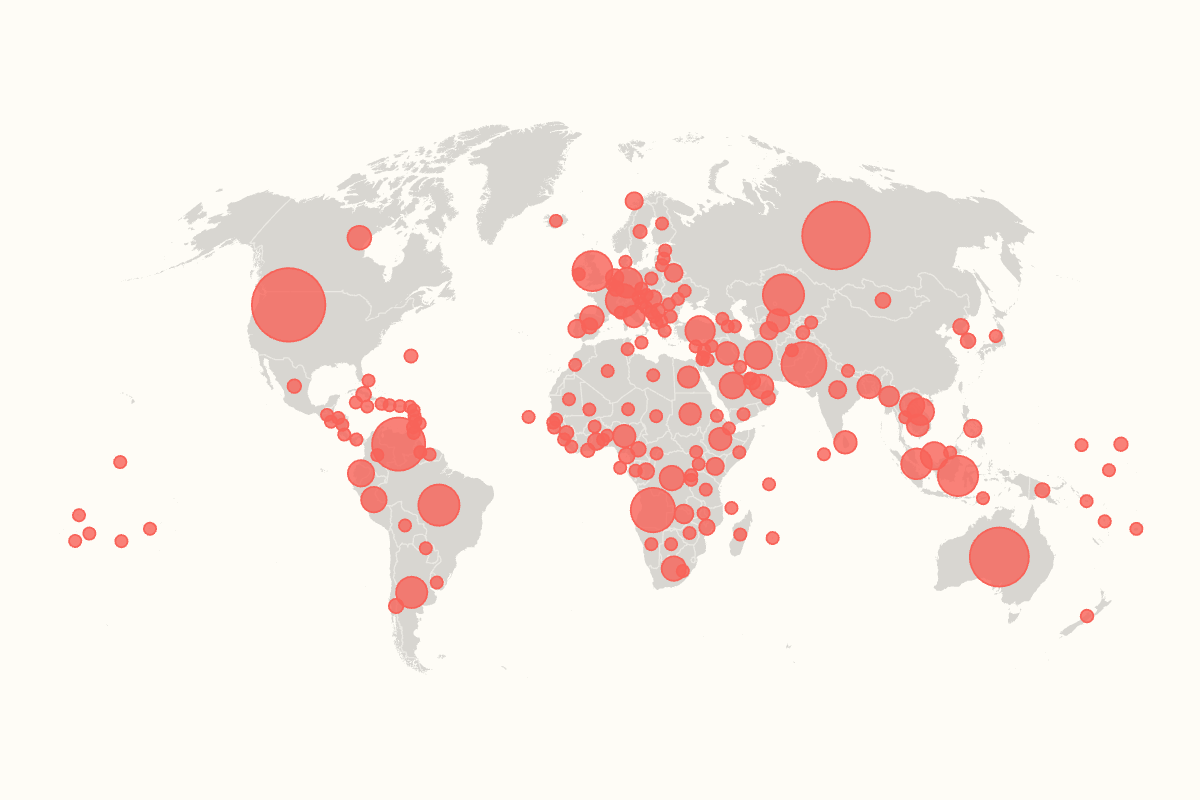

The AidData study, which tracked 30,000 projects across 217 countries over three years, indicates that China’s lending is 2 to 4 times larger than previous estimates. This is significant as it challenges long-held beliefs that Beijing primarily lends to developing nations. Instead, 76 percent of these loans target high- and upper-middle-income countries.

China’s ambitious Belt and Road Initiative has played a vital role in this financial expansion, with major investments across various sectors. The report highlights that the United States tops the list of recipients, having received $202 billion for 2,500 projects during the study period. Following closely are Russia at $172 billion, and Australia with $130 billion. Venezuela and Pakistan also rank high, receiving $105.7 billion and $75.6 billion, respectively. The United Kingdom is not far behind, securing its position as the tenth-largest recipient.

Critics have labeled these loans as “debt-trap diplomacy,” suggesting that they create dependency and financial distress in borrowing countries. However, Chinese officials vehemently reject this narrative, asserting that their lending practices are based on mutually beneficial, market-driven principles.

“China’s financing focuses on infrastructure and capacity-building to enable self-reliance, not create dependency,”

stated Yang Baorong, director of African Studies at the Chinese Academy of Social Sciences.

The AidData report is particularly significant given the context of mounting concerns from the U.S. and its allies about the implications of China’s extensive lending practices. Brad Parks, executive director of AidData, commented: “This is an extraordinary discovery given that the U.S. has spent the better part of the last decade warning other countries of the dangers of accumulating significant debt exposure to China.”

The implications of this report are immediate and profound. Major economies such as the U.S., Germany, and Japan may need to reassess their lending and aid strategies to retain influence in global finance. The authors of the report suggest that China is a “new global pace-setter rewriting the rules and norms that govern the cross-border provision of international aid and credit.”

As this story develops, the global community will be watching closely to see how these revelations impact international relations and economic strategies. The urgency of this situation cannot be overstated, as nations adjust to a rapidly changing financial landscape influenced by China’s unprecedented lending practices.

For real-time updates on this developing story and its implications, stay tuned.