Paramount has formally expressed its opposition to Netflix’s proposed acquisition of Warner Bros. Discovery assets through a letter submitted to a House Judiciary antitrust subcommittee. This development follows Warner Bros. Discovery’s board rejecting Paramount’s recent takeover bid. The letter, filed on March 6, 2024, highlights concerns regarding the competitive landscape of the streaming video on demand (SVOD) market.

Concerns Over Streaming Dominance

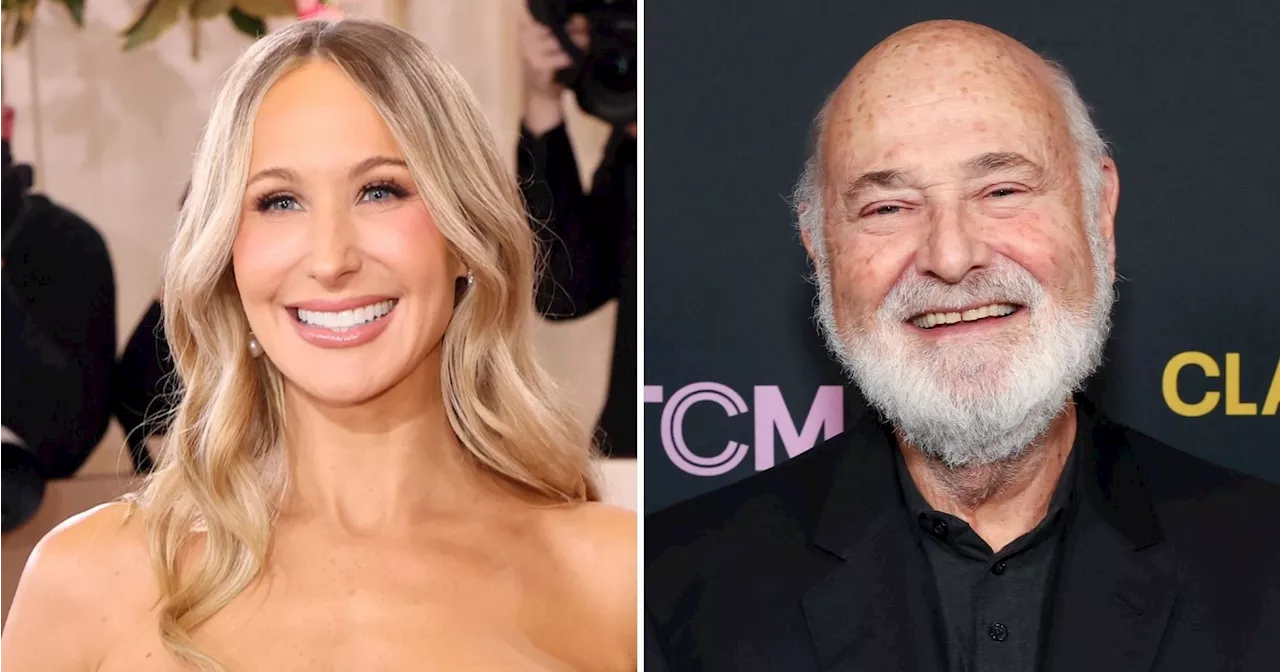

In the letter, Paramount’s chief legal officer, Makan Delrahim, asserted that Netflix’s acquisition would be “presumptively unlawful” and would further entrench the company’s dominance in the SVOD sector. Delrahim’s statements reflect Paramount’s apprehensions about the implications of consolidating such significant assets under one umbrella.

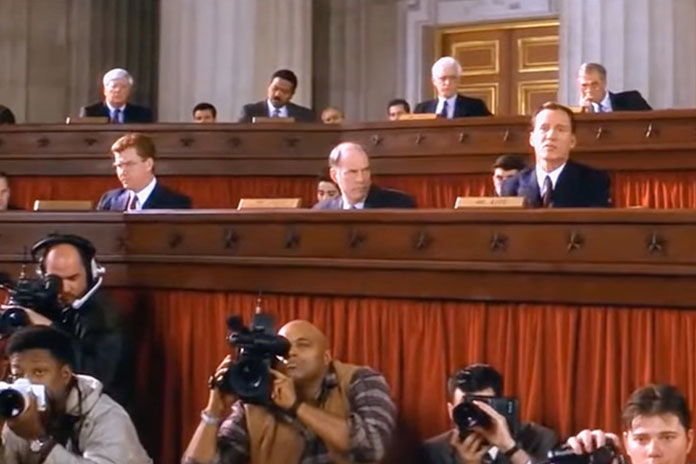

The letter was submitted on the same day the subcommittee convened to discuss the current state of the streaming market, with the potential sale of Warner Bros. Discovery being a primary focus of the hearing. Despite filing the letter, representatives from Paramount did not appear before the subcommittee to present their case in person.

As the streaming landscape evolves, the government’s perspective on Netflix’s position will be crucial. The key question remains whether officials view Netflix as a dominant player within the SVOD market or as a competitor to platforms like YouTube and social media networks such as TikTok and Instagram.

Warner Bros. Discovery’s Strategic Shift

Last month, Warner Bros. Discovery announced its agreement with Netflix, which involves the streaming service purchasing the studio’s assets while WBD’s cable channels will be separated into an independent entity. This deal is part of a broader trend where traditional media companies are re-evaluating their strategies in response to the growing influence of streaming platforms.

Paramount’s letter emphasizes the challenges that such consolidations can pose to competition in the industry. By acquiring Warner Bros. Discovery assets, Netflix could potentially solidify its leading position in the streaming market, limiting opportunities for other companies to compete effectively.

As discussions surrounding this acquisition continue, the implications for viewers, content creators, and competitors alike will be significant. Paramount’s proactive stance demonstrates its commitment to maintaining a competitive landscape in an industry that is rapidly changing.

With the subcommittee’s ongoing evaluation of the streaming market, the outcome of this situation could shape the future of media consumption and competition. Stakeholders are closely monitoring how regulatory bodies will respond to the evolving dynamics of the streaming industry.