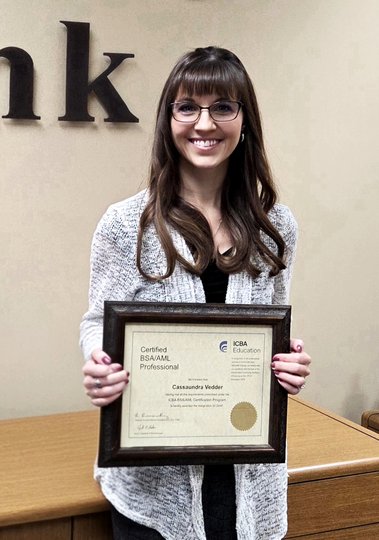

First Kansas Bank has announced that Cassaundra Vedder, the assistant vice president, has successfully completed the Certified BSA/AML Professional program offered by the Independent Community Bankers Association (ICBA). This achievement grants her the professional designation of Certified BSA/AML Professional – CBAP, underscoring her expertise in banking regulations focused on anti-money laundering and Bank Secrecy Act compliance.

The ICBA’s education division provides eleven certification programs, all accredited by the National Association of State Boards of Accountancy (NASBA). To obtain her certification, Vedder attended the recent ICBA BSA/AML Institute and passed a rigorous examination that tested her knowledge of fundamental BSA regulations and their practical applications.

Paul Snapp, President and CEO of First Kansas Bank, praised Vedder’s commitment to her professional development. He stated, “With this certification, Cassaundra has demonstrated a mastery of key banking concepts for professional development. This certification will contribute to the safety and soundness of First Kansas Bank’s operations. I commend her for her hard work in completing this difficult and important banking educational program.”

Vedder’s accomplishment is significant for First Kansas Bank, which operates branches in Hoisington, Claflin, Great Bend, and Hays. By enhancing her qualifications, she strengthens the bank’s ability to comply with essential financial regulations, thereby promoting a secure banking environment for its customers.

As financial regulations continue to evolve, certifications like the one obtained by Vedder play a crucial role in ensuring that banking professionals are equipped with the latest knowledge and skills. This commitment to education reflects the bank’s dedication to maintaining high standards of integrity and compliance within the industry.

The bank encourages continued professional development among its staff, recognizing that well-trained employees are vital to the institution’s long-term success and reliability in the financial sector. As the landscape of banking becomes increasingly complex, initiatives that support ongoing education will be key to navigating future challenges.