URGENT UPDATE: Californians are pulling back from major purchases, with new reports revealing significant declines in both home and vehicle sales across the state. As of mid-2025, economic uncertainty has consumers hesitant, reflecting a market shift that could impact the broader economy.

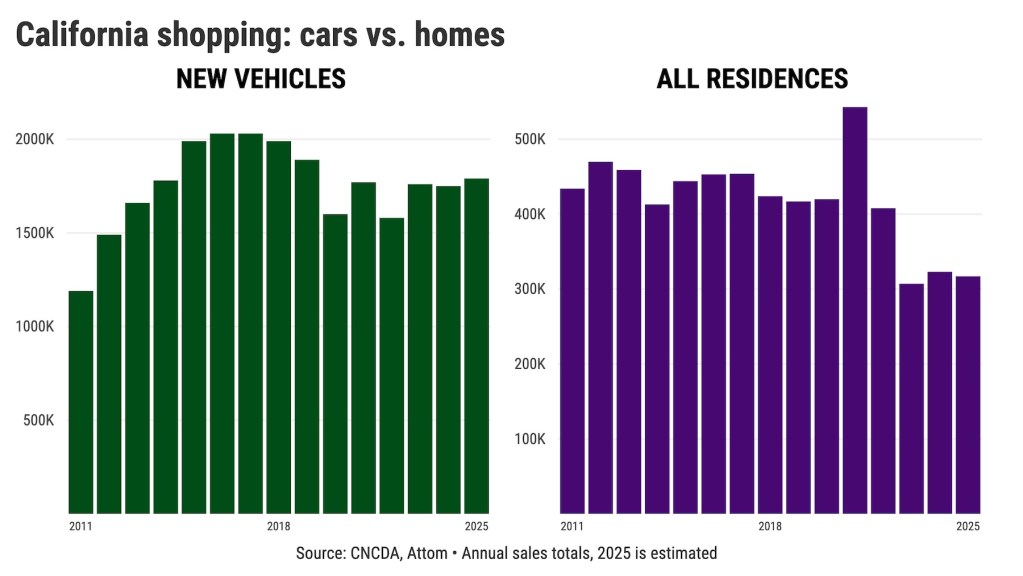

In a stark indication of consumer reluctance, the California New Car Dealer Association estimates that 1.79 million vehicles will be sold in California this year—merely a 2% increase from 2024. This follows a slight decline in vehicle sales last year, indicating a flat market trajectory. Meanwhile, home purchases are also plummeting, with projections for 317,000 residences sold in 2025, marking a 2% drop year over year.

These trends highlight a worrying sentiment among Californians, as economic stability remains elusive. Consumer confidence has dipped statewide, driven by stagnant hiring and rising inflation that is squeezing household budgets. The average price of a new car has surged past $50,000, while the high cost of living in California poses additional barriers for consumers.

Interest rates are compounding these challenges. As of mid-2025, the average rate for a five-year car loan has climbed to 7.9%, up from 4.5% in 2022. Similarly, the mortgage rate for a 30-year loan now stands at 6.8%, a sharp rise from 2.9% in 2020. These financial pressures are causing potential buyers to reconsider their purchasing decisions.

California’s vehicle sales are currently 12% below the highs of 2.03 million sales recorded in 2016 and 2017, before the pandemic disrupted the economy. Homebuyers are facing an even steeper decline, with sales expected to be a staggering 42% lower than the peak of 543,000 in 2021, when low mortgage rates and pandemic-driven demand fueled a housing boom.

John Sackrison, executive director of the Orange County Auto Dealers Association, attributes the sluggish vehicle sales to lingering supply chain issues from the pandemic. He noted, “Uncertainty tends to make consumers pull back.” As a response, manufacturers are introducing incentives aimed at moving slow-selling models, but consumer hesitation remains.

This trend is not isolated to California. Nationally, vehicle sales are on pace for 16.3 million annually, reflecting a 3% decline from last year. Homebuying across the United States is similarly slow, with an annual pace of 4 million, also down 2% from 2024.

The economic landscape is shifting rapidly, and Californians are feeling the impact of these developments. As consumers navigate rising costs and financial uncertainty, the future of both the automotive and housing markets hangs in the balance.

Stay tuned for further updates as this situation develops, highlighting the urgent need for economic recovery strategies that restore confidence among buyers.