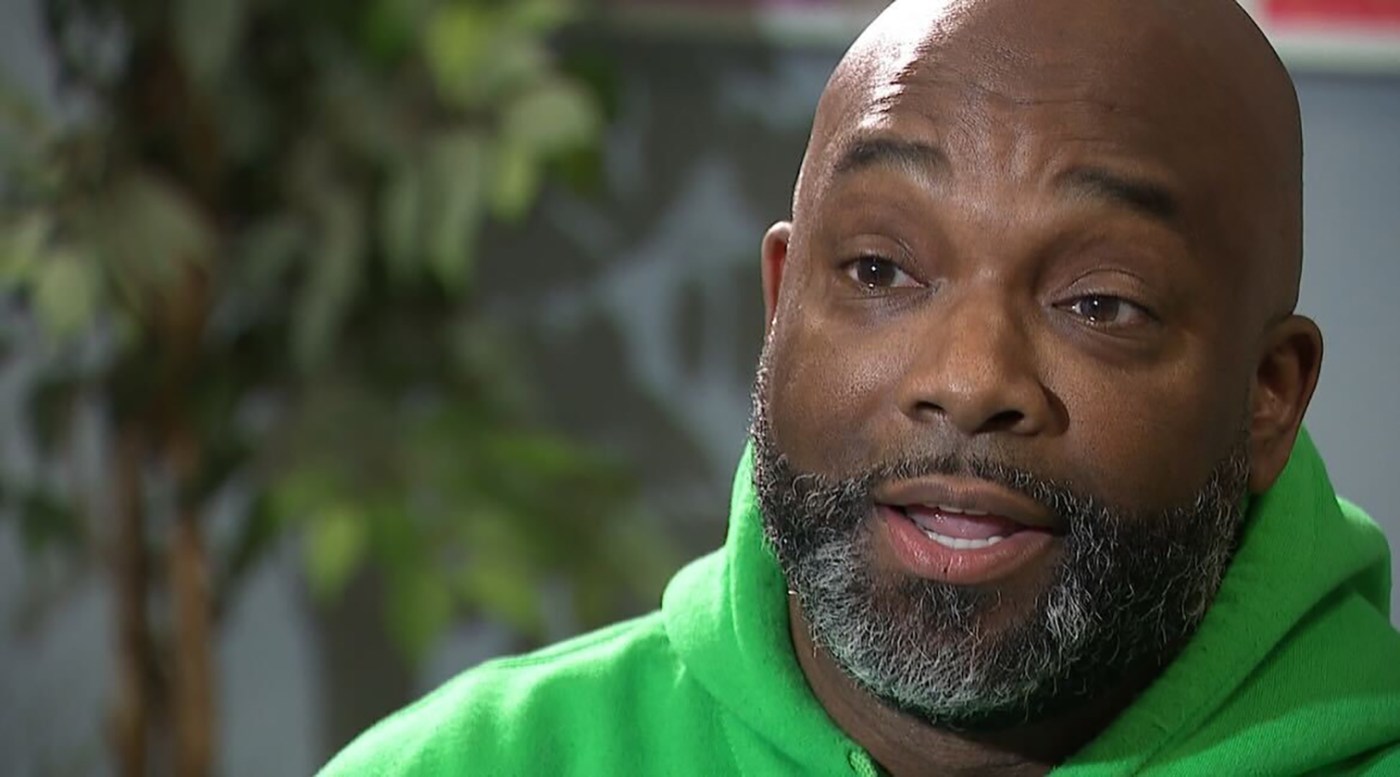

UPDATE: Maryland has just awarded $6 million in taxpayer funds to the nonprofit organization We Our Us, whose president, Antoine Burton, is facing a staggering tax debt exceeding $200,000. This urgent revelation raises significant concerns about the vetting process for nonprofits receiving substantial public funding.

Court documents obtained by Spotlight on Maryland reveal that Burton owes $176,000 in federal tax liens and $32,000 in Maryland tax liens, dating back to 2017. Governor Wes Moore awarded the contract through the Department of Juvenile Services (DJS) in August, intended to “engage justice-involved youth in Baltimore City.”

“This partnership produces progress, and there’s no better case study than Baltimore,” Moore stated in the announcement, just weeks after criticizing former President Donald Trump for his comments on deploying the National Guard in the city. The timing of this contract has raised eyebrows, especially following a community event where Mayor Brandon Scott touted We Our Us as a key player in crime prevention efforts.

The $6 million funding was disclosed two weeks after Moore’s public safety remarks, intensifying scrutiny over the decision-making process. Spotlight on Maryland pressed Burton on his ability to manage taxpayer dollars while in debt, to which he asserted, “I have a plan in place to resolve the tax liens,” yet did not provide supporting documents.

Despite his tax issues, a DJS spokesperson confirmed that We Our Us is in good standing with the State Department of Assessments and Taxation, making it eligible for state funding. However, the organization has yet to submit invoices for the newly awarded contract that began in September. The spokesperson emphasized that DJS maintains oversight of the organization’s performance and youth engagement.

Critically, We Our Us reported $328,427 in total income in its last tax filing for fiscal year 2022, with 14 part-time employees, including Burton, reportedly working only 15 hours per week. Burton claims that the organization has transitioned to full-time staff post-award.

Experts are questioning the appropriateness of funding such entities without thorough financial scrutiny. Amanda Beck, a professor specializing in nonprofit accounting, stated, “It’s reasonable to consider the stewardship that this individual has had in their own financial relationship with the government when making an award of this size.”

Further complicating matters, We Our Us has not filed tax forms for fiscal years 2023 and 2024, which were due last May. Burton’s team claims they are currently undergoing a voluntary financial audit and have requested an extension from the IRS. However, experts like Erica Harris assert that organizations should still file estimated returns during audits.

Burton insists that the awarded funds will enhance community services, including food assistance, addiction recovery support, job placement, and youth mentorship. “We are embedded in the lives of these kids,” he emphasized, highlighting the personal connections formed through their outreach efforts.

However, amidst these claims, court records indicate that Burton’s personal life is tumultuous. His recent divorce, finalized in October, revealed allegations of financial deception, including undisclosed tax liens and significant debts. Burton denied these allegations, stating, “I did not hide any finances from my wife,” but the divorce judgment mandates he pay his ex-wife $6,790 and all net proceeds from the sale of their Baltimore County home.

Spotlight on Maryland has uncovered that the contract with DJS was awarded through a “Non-Competitive Negotiated Procurement,” a process that allows for direct awards without bids under certain conditions. Critics, including Beck, express concern over the lack of competitive bidding, questioning the rationale behind selecting a single organization for such contracts.

In addition to the state funding, We Our Us is poised to receive $1 million from Baltimore City’s opioid settlement with Walgreens, according to Mayor Scott. However, the mayor’s office has not commented on the implications of Burton’s tax issues or the delayed financial reporting from We Our Us.

As this story develops, the focus remains on how Maryland’s government will address the transparency and accountability of nonprofit funding, especially amid rising public concern. Stay tuned for more updates on this pressing issue.