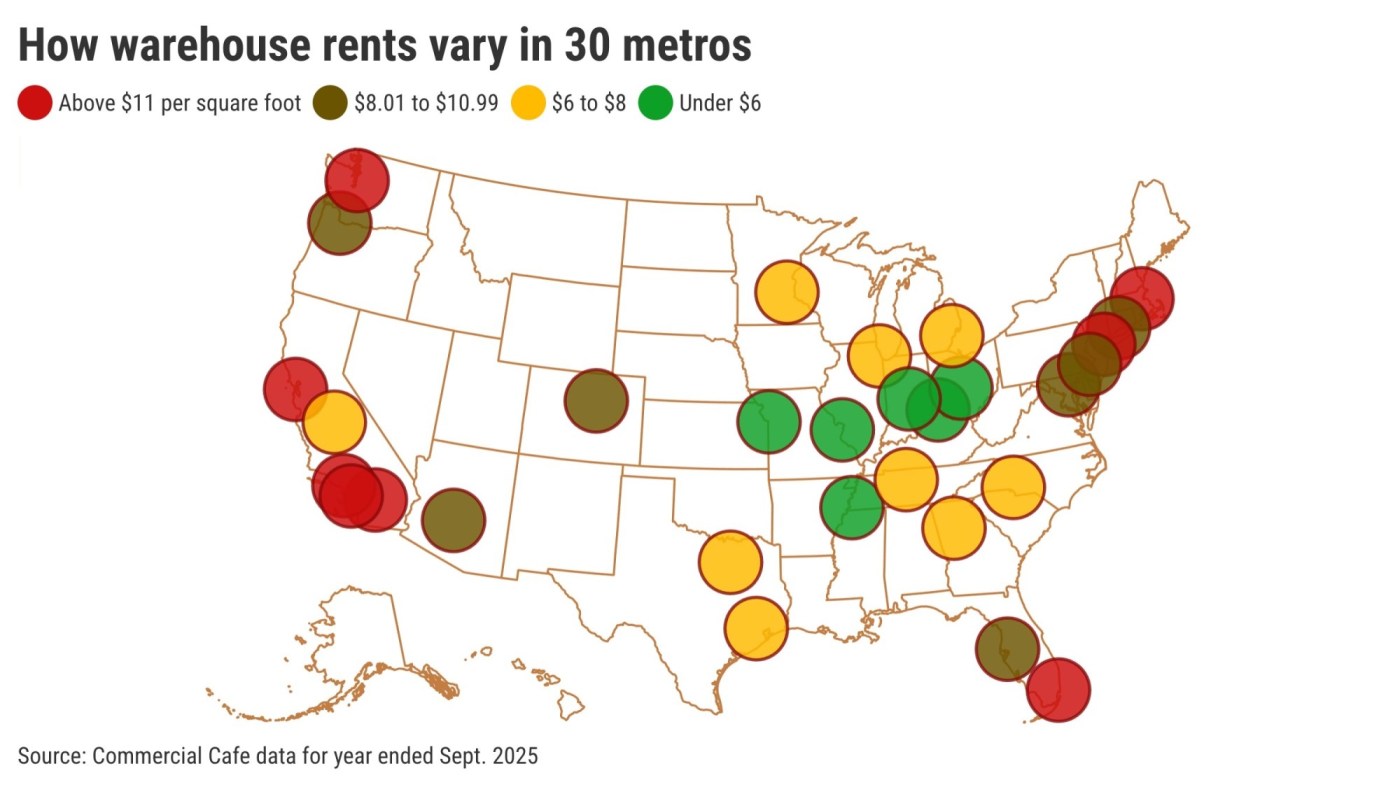

UPDATE: Southern California’s industrial rent prices have skyrocketed, solidifying the region as the most expensive in the nation for warehouse space. A new report from Commercial Cafe reveals that as of September 2023, Orange County tops the list with an average rent of $17.09 per square foot, marking a 7% increase over the past year.

The report highlights that new tenants in Orange County are paying as much as $19 per square foot, the highest rate in the country. Meanwhile, the Los Angeles market follows closely with average rents of $15.59 per square foot, also representing a 5% rise from the previous year.

These staggering costs are driving a surge in warehouse development across the Inland Empire, where rents remain comparatively lower at $11.65 per square foot—ranking 7th nationally and reflecting an 8% increase year-over-year. New leases in this area average $14.58 per square foot, further underscoring the region’s appeal for logistics operations.

Southern California’s proximity to the Los Angeles/Long Beach ports, one of the largest shipping hubs globally, coupled with demands from the nation’s second-most populous region, is fueling these high rental rates. Despite the premium prices, available warehouse space remains scarce, with vacancy rates significantly lower than the national average; the Inland Empire boasts just 7.7% vacancy, while Los Angeles and Orange County report 8.3% and 8.2% respectively.

The implications of these rising costs extend beyond mere numbers. The Orange County industrial properties have sold for an average of $306 per square foot in the first nine months of 2023, positioning it as the second-highest market behind Detroit at $624 per square foot. In comparison, warehouses in Los Angeles sold for $282 per square foot, ranking 3rd nationally, while the Inland Empire saw prices at $234 per square foot, placing it 6th in the market.

These developments are reshaping the landscape of commercial real estate in Southern California and reflect the ongoing demand for logistics and distribution centers in a region where supply struggles to keep pace with relentless demand. As businesses continue to flock to these areas, the future of industrial real estate in Southern California remains poised for significant changes.

Stay tuned for further updates on this developing story, as these trends could impact not only local economies but also the broader implications for national logistics and distribution networks.