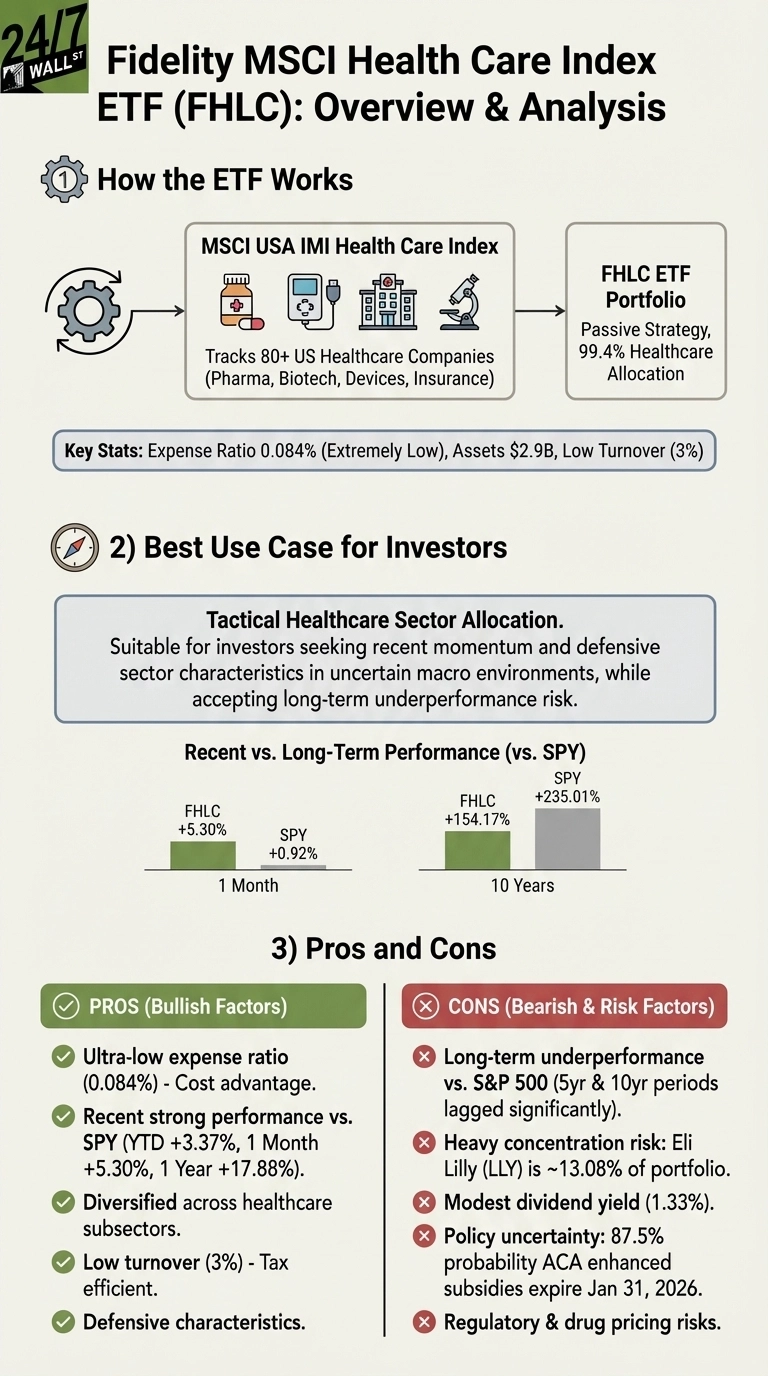

Investors are closely examining the prospects of the **Fidelity MSCI Health Care Index ETF (FHLC)** as it presents both opportunities and risks in a fluctuating market. With an expense ratio of just **0.084%**, the fund has attracted attention for its low-cost entry into the healthcare sector, but its heavy reliance on a few key stocks raises concerns.

The FHLC ETF tracks the **MSCI USA IMI Health Care Index**, offering exposure to a diverse range of **U.S. healthcare companies** spanning pharmaceuticals, biotechnology, medical devices, and health insurance. However, it currently holds over **13%** of its assets in **Eli Lilly (NYSE: LLY)**, which has seen a **46%** surge in stock price over the past year, largely due to the success of its **GLP-1 obesity drugs**. This concentration can significantly impact the fund’s performance, especially if Eli Lilly experiences any setbacks.

Despite its recent gains—**17.9%** over the past year and outperforming the **S&P 500** in the short term—the long-term picture for FHLC is less rosy. Over the past five years, the ETF has returned only **42.6%**, compared to the S&P 500’s **84.5%**. The ten-year figures further illustrate this disparity, with FHLC returning **154%** versus the S&P’s **235%**. These numbers reflect ongoing challenges within the healthcare sector, including drug pricing pressures and evolving regulatory landscapes.

Performance and Risks

Investors should also consider the potential policy risks affecting the healthcare landscape. Current predictions suggest an **87.5%** likelihood that enhanced **Affordable Care Act (ACA)** premium tax credits will expire by **January 31, 2026**. Such changes could adversely affect health insurers like **UnitedHealth (NYSE: UNH)**, which constitutes **4.5%** of the FHLC portfolio and has already seen a **31%** decline in its stock value over the past year. Additionally, ongoing negotiations regarding drug pricing under Medicare continue to pose risks to pharmaceutical stocks.

While FHLC’s yield stands at **1.33%**, this figure may seem modest compared to other investment opportunities, particularly given that the fund’s dividends have grown at an annual rate of **4.6%** over the past five years. This increase barely keeps pace with inflation and falls short of the income potential found in other defensive sectors.

Alternatives for Investors

For investors prioritizing growth and capital appreciation, FHLC may not be the ideal choice. Its historical underperformance relative to broader market indices suggests that those with aggressive portfolios should seek alternatives. Similarly, retirees seeking reliable income might find better yields in other sectors without sacrificing stability.

An alternative worth considering is the **Vanguard Health Care ETF (NYSEARCA: VHT)**. With an expense ratio of **0.09%** and assets totaling **$20.4 billion**, VHT provides greater liquidity and a slightly higher dividend yield of **1.38%**. Both funds share similar top holdings, with Eli Lilly leading, but VHT’s larger asset base and a 22-year track record since its inception in **2004** offer additional reassurance for long-term investors.

Ultimately, FHLC may serve as a tactical allocation for those seeking low-cost exposure to the healthcare sector, especially if they believe in its recent momentum. However, investors must weigh the concentration risk and historical performance against their individual investment goals.