URGENT UPDATE: Central banks are rapidly changing their stance on gold as a viable currency alternative, with significant implications for the global economy. Recent trends indicate that central banks are investing heavily in gold reserves, signaling a potential shift away from traditional fiat currencies.

This development comes as the value of the U.S. dollar has depreciated by a staggering 99 percent against gold since the 1944 Bretton Woods Conference. The U.S. Treasury’s unrealized profit from its gold holdings has now reached approximately $1 trillion, highlighting the growing value of gold as a safe haven asset.

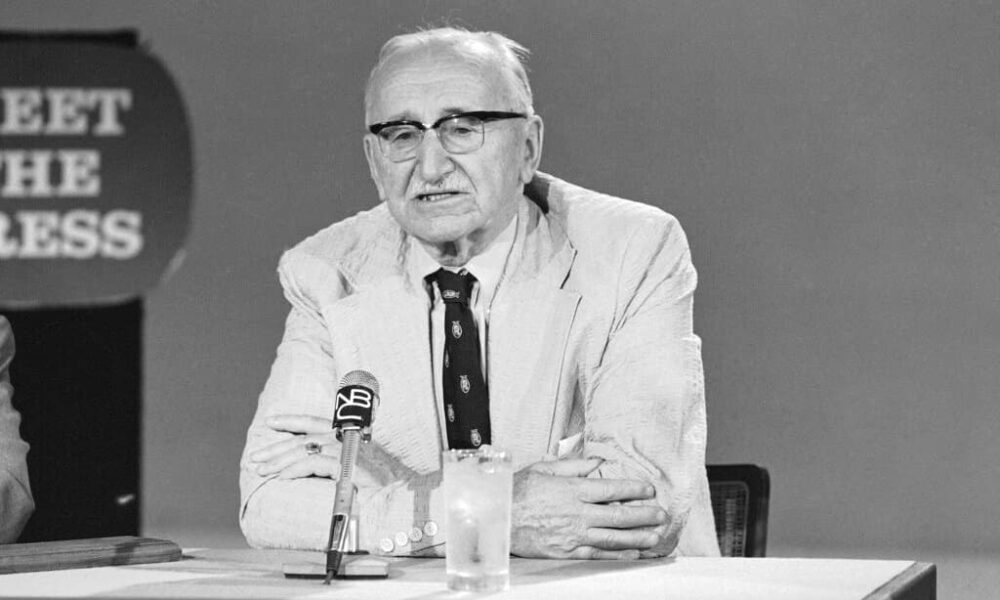

The current economic climate has prompted discussions reminiscent of economist Friedrich Hayek‘s views on currency choice. Hayek argued that governments, by monopolizing currency issuance, undermine public trust and purchasing power. He famously stated, “Practically all governments of history have used their exclusive power to issue money in order to defraud and plunder the people.” As central banks grapple with inflation and currency stability, Hayek’s insights are gaining renewed relevance.

Recent reports confirm that numerous central banks are increasing their gold allocations amid fears of fiat currency inflation. This trend raises questions about the future of monetary policy and the role of gold as a competitive currency. Harry Dexter White, a key figure from the Bretton Woods Conference, once equated the U.S. dollar with gold, a notion that is now being challenged as the dollar’s value continues to falter.

The implications of this shift are profound. As central banks turn to gold, citizens may begin to question the reliability of their own currencies. The public’s confidence in fiat money is waning, leading to calls for more competition among currencies, a principle strongly advocated by Hayek.

WHAT TO WATCH FOR: Analysts predict that if this trend continues, we may witness a significant transformation in how currencies are perceived and utilized on a global scale. The potential for gold to reassert itself as a leading currency could reshape economic landscapes, particularly in nations facing currency crises.

The urgency of this situation cannot be overstated. As central banks adapt to changing economic realities, the choice of currency is becoming a pressing concern for individuals and economies alike. The potential return to gold as a primary currency option could redefine financial stability for generations to come.

Stay informed as this developing story unfolds, and consider the implications for your financial future. The world is watching how central banks navigate these turbulent waters, and the choice in currency may very well determine the stability of economies worldwide.