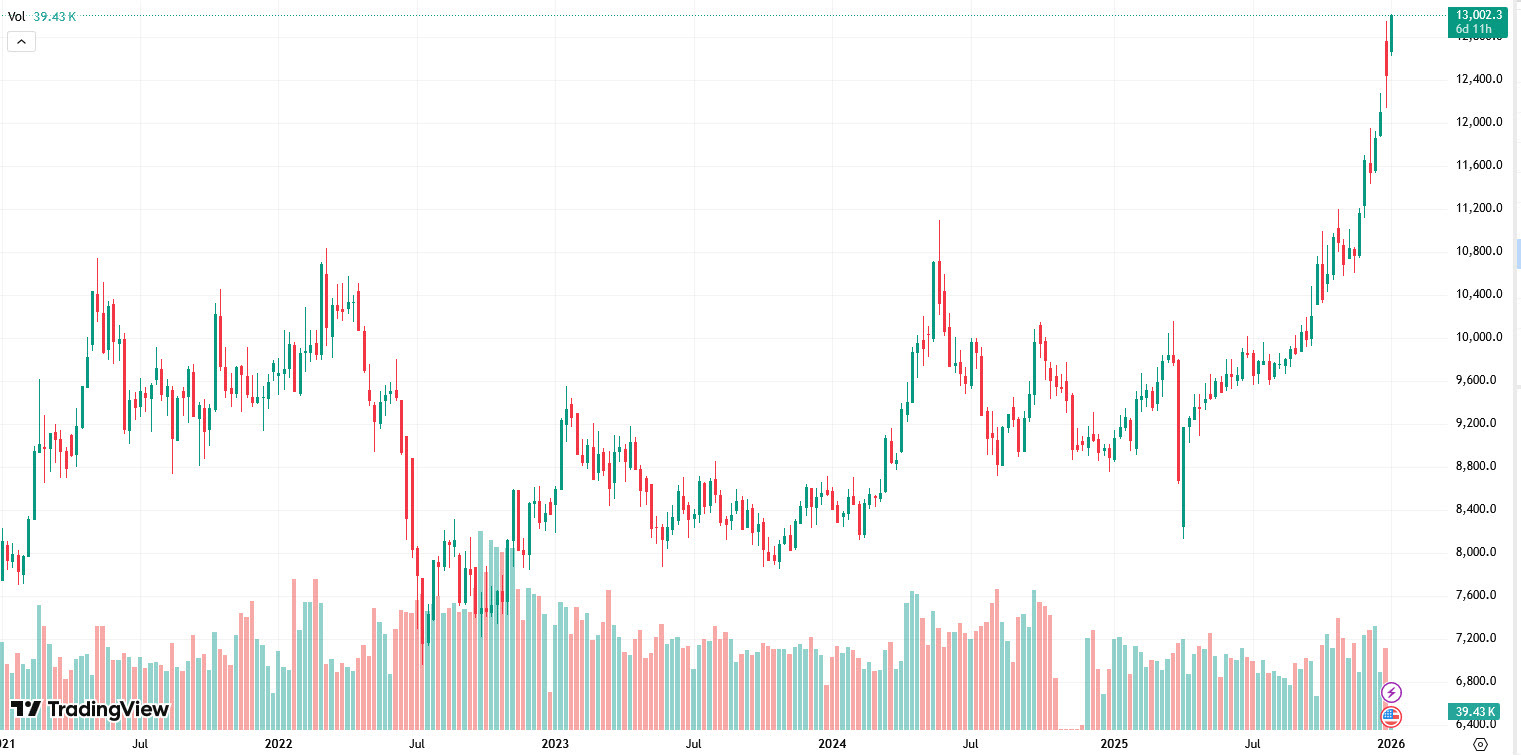

URGENT UPDATE: London copper prices have skyrocketed to a record high of $13,000 per ton, marking a significant turning point in the copper market. This surge comes amidst escalating supply concerns fueled by a strike at Capstone Copper’s Mantoverde Mine in Chile, where approximately half the workforce has walked off the job after failed mediation efforts.

The strike, initiated on Friday, has caused the Mantoverde Mine to operate at only 30% capacity. This disruption is crucial, especially considering the ongoing supply gap exacerbated by the tragic mudslide at the Grasberg Mine, which is anticipated to remain offline for most of the year. Reports indicate that the affected production could range from 29,000 to 32,000 tons during the strike period, a significant loss in an already tight market.

As the copper market grapples with these supply shocks, the implications are profound. The Grasberg Mine, a major copper producer, is expected to see a phased return starting in Q2 of this year, but the ongoing strike at Mantoverde adds another layer of complexity. The Atacama region, where Mantoverde is located, is adjacent to the Antofagasta region, home to some of the world’s largest copper mines.

“Labor dissatisfaction could spark a broader push for higher wages and more disruptions,” analysts warn.

Furthermore, the situation is intensified by the approaching expiration of multiple union contracts at Chile’s state-run Codelco, which could lead to further strikes and production slowdowns. Notable negotiations are also underway at Centinela, while Anglo American’s Los Bronces is facing tough discussions later this year.

The urgency of these developments cannot be overstated. With copper already in a bullish trend, experts indicate that if current conditions persist, prices could rise significantly, with targets reaching upwards of $16,000 by 2025.

As the global market watches closely, the immediate impact of these disruptions will resonate far beyond Chile. Investors are advised to monitor the situation as labor negotiations unfold and production forecasts become clearer.

In summary, the combination of ongoing labor strikes and significant supply challenges is setting the stage for a critical period in the copper industry. The ramifications of these developments will be felt globally, affecting everything from production to pricing in the months to come.