UPDATE: Hawaiian Electric Industries Inc. has just announced a massive investment plan totaling $2 billion aimed at reducing wildfire risks and enhancing power generation across Hawaii. This urgent initiative is set to unfold over the next three years, following a devastating wildfire that claimed over 100 lives and destroyed thousands of homes in Lahaina.

The company revealed these significant plans during a conference call on September 30, 2023, where it also reported a third consecutive quarterly profit of $31 million, a remarkable recovery from a $104 million loss in the previous year. Hawaiian Electric, which serves Hawaii Island, Oahu, Maui, Molokai, and Lanai, will allocate between $1.75 billion and $2.35 billion on capital improvement projects from 2026 through 2028.

The financial backing for this extensive plan will come from both retained profits and newly issued debt, including a recently increased credit facility of $600 million. This comes as Hawaiian Electric prepares to meet its obligations related to a $2 billion settlement for the wildfire disaster, which is due in four equal annual payments starting no earlier than 2026.

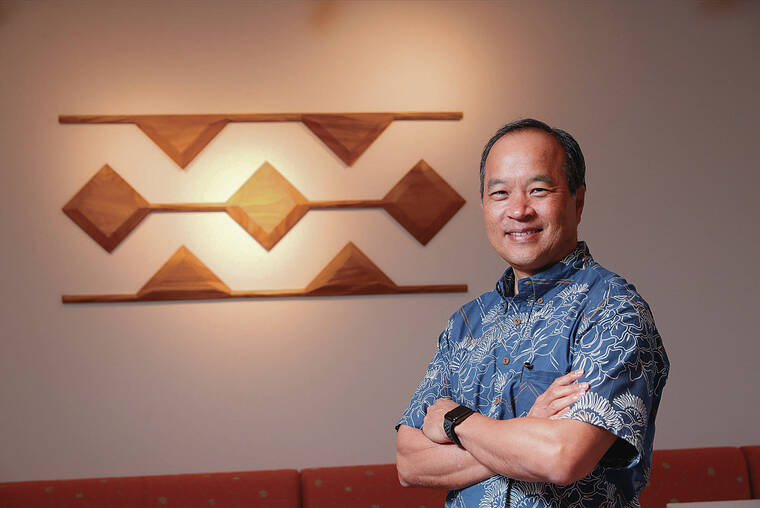

“These investments will enhance liquidity, supporting improvements in safety, reliability, and resilience,” stated Scott Seu, HEI president and CEO.

Since the catastrophic fires on August 8, 2023, Hawaiian Electric has been under scrutiny for its equipment’s role in the disaster. The company has vowed to implement rigorous safety measures, including the installation of 101 weather stations in high-risk areas and the use of 135 A.I.-assisted video cameras to detect fires swiftly.

As part of its wildfire safety strategy, HEI has already replaced or upgraded 3,628 wood poles and 36 miles of copper power lines with stronger aluminum alternatives. These proactive steps aim to significantly reduce the risk of another catastrophic event.

However, the financial implications of these improvements may lead to higher rates for Hawaiian Electric customers, pending approval from the state Public Utilities Commission. The urgency of this investment comes as the company grapples with the aftermath of the devastating fires and the ongoing litigation from victims.

HEI’s shares closed at $11.20 following the earnings announcement, a stark contrast to $37.36 just before the wildfire disaster. Investors are closely watching how the company navigates these challenges while committing to community safety and infrastructure resilience.

Looking ahead, Hawaiian Electric’s ambitious plans to enhance its infrastructure are crucial not only for the company’s future but also for the safety of the communities it serves. The next steps will involve ongoing assessments and further investment strategies aimed at prioritizing fire safety and reliability in Hawaii.