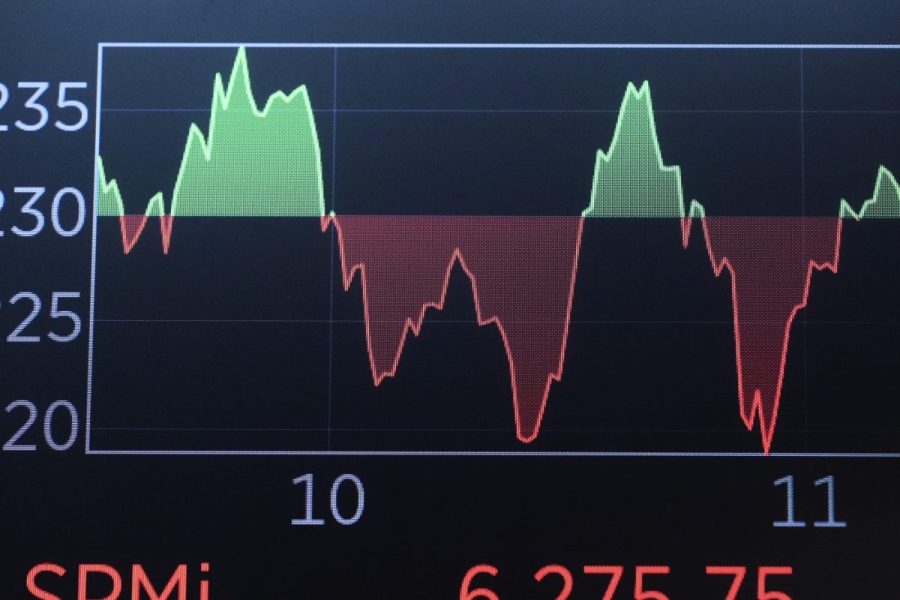

UPDATE: Investors are closely monitoring the potential for a significant Santa Claus rally in the stock market this December, driven by a surge in holiday shopping and consumer optimism. As of December 1, 2023, reports show that retail sales have jumped by 7% compared to last year, thanks to increased spending fueled by year-end bonuses.

The Santa Claus rally, typically occurring in the final week of December, is characterized by rising stock prices as investors react to positive economic indicators. This year, the mood is especially buoyant as shoppers flock to stores and online platforms, indicating robust consumer confidence. Analysts predict that this surge in spending could push major indices higher, making it a crucial period for investors.

Recent data highlights that shoppers are projected to spend an average of $1,200 each on gifts, up from $1,050 last year. This optimism is further bolstered by stronger-than-expected economic forecasts, which have many experts believing that the stock market could see significant gains.

According to the National Retail Federation, consumer spending is expected to reach an all-time high this season, with major retailers reporting record foot traffic. With Cyber Monday sales alone exceeding $12 billion, investors are eager to see how these trends will impact stock prices in the coming weeks.

The implications of a Santa Claus rally extend beyond just financial markets; they reflect broader economic health and consumer sentiment. A substantial rally could enhance investor confidence, leading to increased investments heading into 2024.

Looking ahead, market analysts urge investors to keep a close watch on retail earnings reports slated for mid-December, as these will provide critical insights into the success of holiday sales and their potential impact on the overall economy. Key dates include earnings releases from major retailers like Walmart and Amazon, which are set for December 15, 2023.

The Santa Claus rally offers a unique opportunity for investors, but experts advise caution. While the current trends are promising, market volatility remains a concern. Investors are encouraged to remain informed about economic developments and consumer behavior as the holiday season progresses.

This year’s potential for a Santa Claus rally is not just a financial phenomenon; it reflects the emotional and social dynamics of the holiday season, where consumer optimism can play a pivotal role in shaping market trends. As December 2023 unfolds, all eyes will be on the stock market to see if this festive spirit translates into substantial gains.

Stay tuned for the latest updates as this story develops, and prepare for a potentially exciting end to 2023 in the financial markets.